Factur-X, the electronic invoicing format chosen by Factomos

Registered in the European standard EN16931, Factur-X is the Franco-German standard for mixed electronic invoices (PDF embedded XML) that we have chosen at Factomos. Compatible with Chorus-Pro, it brings great added value to our invoices.

There are two types of electronic invoices

An electronic invoice is an invoice issued, sent and received in electronic form.

Today, two types of electronic invoices exist:

Today, two types of electronic invoices exist:

- the simple PDF invoice : it is the digital invoice that we read like a paper invoice. None of its data is automatically exploitable.

- the structured invoice : also called e-bill, where all information is managed in the form of data, which can be used automatically.

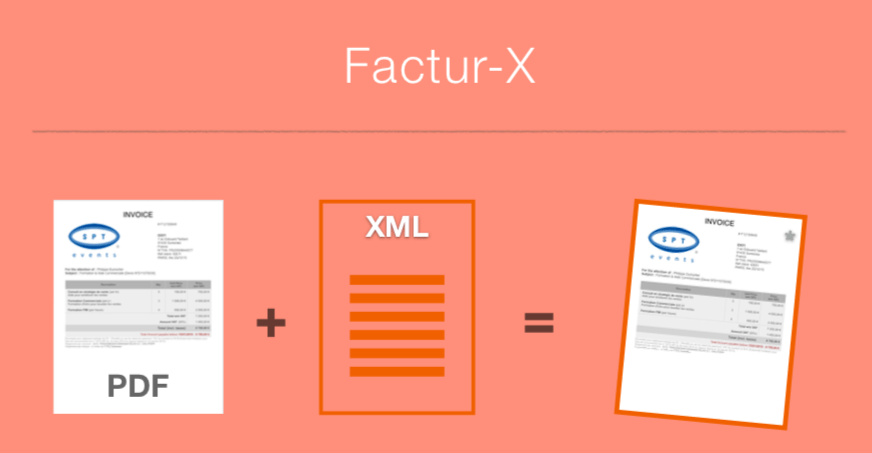

Factur-X, a mixed invoice format

If the digital invoice is intended for humans - who can read it, re-enter and validate the information contained therein, - the e-invoice is therefore intended for information systems - which proceed by automated integration and reconciliation .

So what to choose? The human or the machine?

At Factomos, the answer is clear: all our invoices, both on dispatch and on receipt, are addressed simultaneously to people AND to the machine. And this, thanks to Factur-X.

A hybrid format, Factur-X is both human readable in PDF and machine readable in XML.

At Factomos, the answer is clear: all our invoices, both on dispatch and on receipt, are addressed simultaneously to people AND to the machine. And this, thanks to Factur-X.

A hybrid format, Factur-X is both human readable in PDF and machine readable in XML.

Several advantages offered by Factur-X,

including the deposit on Chorus-Pro from Factomos

This hybrid invoice format offers many advantages to Factomos customers:

- more flexibility, with optimized exchange processes

- a global acceleration : transmission and processing of data, therefore delays in paying invoices and collecting VAT

- hence a reduction of cash flow difficulties VSEs / SMEs

- a international openness, due to the European standard to which it meets

- a guarantee of tax compliance

- the possibility ofinclude supporting documents of the type of purchase order, delivery note, CGV in the general “envelope”

- and finally, the possibility of deposit his invoices in Chorus Pro, while remaining in its own billing environment.

This last point, the deposit on Chorus Pro offers additional convenience to our Factomos customers who issue invoices to the Public Market. See the deposit obligation on Chorus Pro, here.