State suppliers:

all in Chorus Pro!

all in Chorus Pro!

There you go, 2020, here we are. Any company - from -10 to 5000 employees, - which issues invoices to Public Administrations must submit its invoices on the Chorus Pro platform. Nothing could be simpler with Factomos ...

Chorus Pro is an obligation

Created by the AIFE (Agency for State Financial Informatics), Chorus Pro first of all responded to the imperative for the State, local authorities and their public establishments to be able to receive electronic invoices.

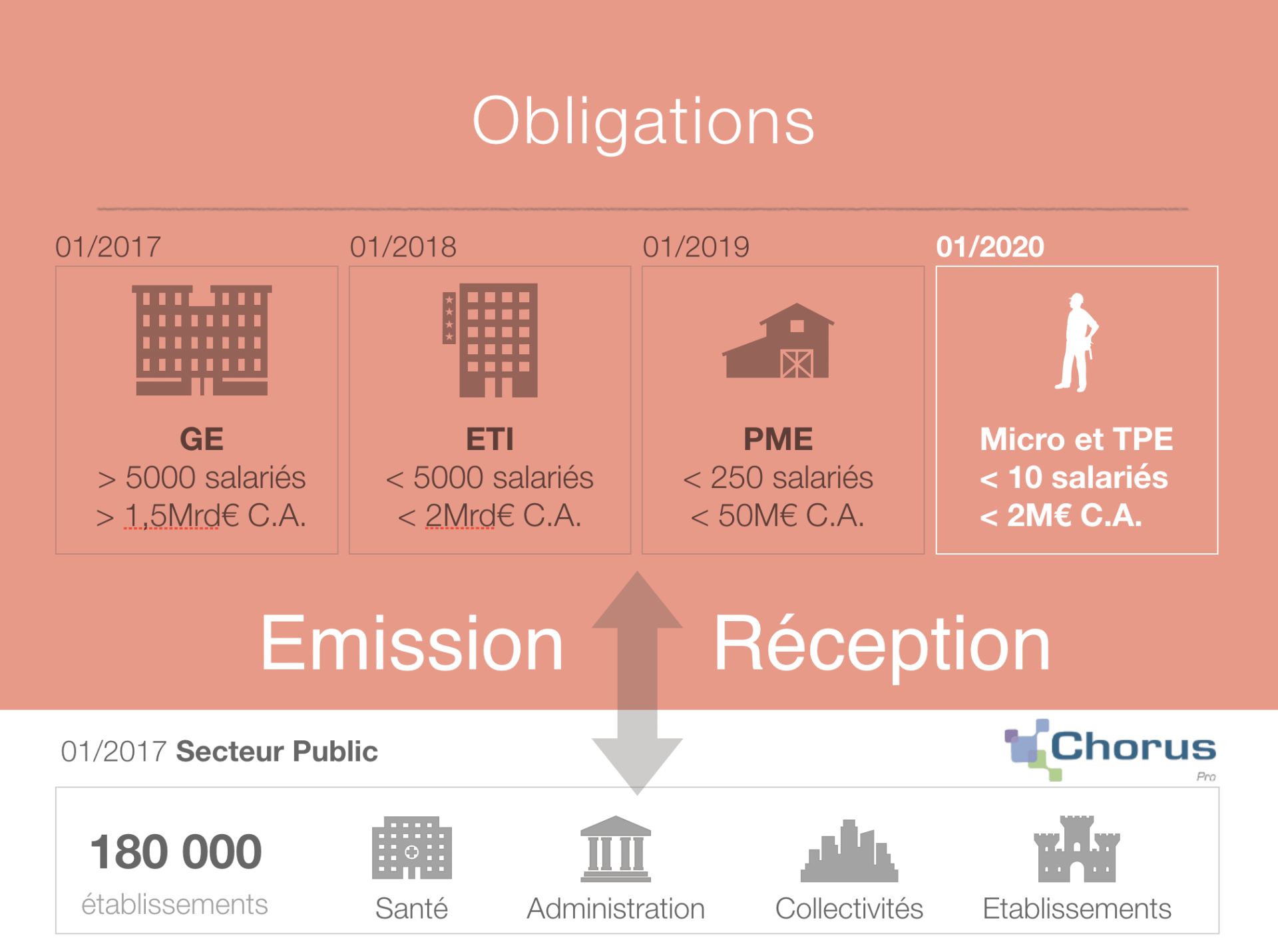

From there, a schedule of deposit obligations on the Chorus Pro platform has been set up for companies: from the largest, on January 1, 2017, to the smallest, on January 1, 2020.

Chorus Pro is the obligation to issue electronic invoices

All government suppliers must therefore submit their invoices to Chorus Pro today. In other words, any government supplier company must issue dematerialized invoices.

Goodbye paper invoices !!

In one step, three movements:

> Chorus Pro receives electronic invoices

Please note, an electronic invoice can in no way be confused with a scan or image file. Either it is a digital invoice, edited in PDF format, or it is a structured invoice, edited in XML format. It can also be a mixture of the two: PDF XML, in the case of Factur-X for example, which we use on Factomos.

> Chorus Pro sends invoices to their recipients

Any invoice filed in Chorus Pro is sent to the local authority or local public institution, which integrates it into its information system and then sends it to its assigned accountant.

> Chorus Pro archives the invoices at the DGFIP

The invoices and attachments associated with the deposit on Chorus Pro are stored in ATLAS, the DGFIP's archiving silo, for a period of 10 years. During this period, all the documents deposited will be accessible to the issuing supplier from Chorus Pro.

To deposit on Chorus Pro: three solutions

> The deposit in Portal mode

The supplier connects to his Chorus Pro account and imports the invoice file from his computer. Usually a PDF, signed or not. From there, Chorus Pro automatically retrieves the data recognized in the deposit form, which the supplier then checks.

See the AIFE Chorus Pro Deposit tutorial here.

> Filing in EDI mode

This deposit method is reserved for high-performance information systems, which are capable of automatically constituting XML flows, and which process large volumes of invoices.

> Deposit in Service mode, via API

Last but not least, the deposit that we offer you on Factomos, for your convenience: filing via API. To put it simply, once you have edited your invoice in Factomos, you send it from your tab dedicated to Chorus Pro. Notifications then inform you of the processing of your invoice.

In all cases: we register on Chorus Pro

The supplier is free to choose among these modes the one that suits him best, he can even combine them with each other. The only requirement: first create an account on Chorus Pro.

2020 and one more asset:

Factomos is 100% compatible with Chorus Pro

The technology chosen by Factomos for its invoices is Factur-X. A mixed format that allows humans to read the invoice (PDF side) and allows the machine to retrieve the data that structures it (XML side).

These high added-value invoices therefore find more interest today: allowing you to invoice Public Administrations without leaving your invoicing universe. Everything is centralized in the greatest conformity and with an even greater time saving.

Ready for a free try

(if you have not yet subscribed to Factomos)?